Others, however-like restaurants and entertainment-might require a trip down money memory lane. You will likely know some expenses-like rent-off the top of your head. emergency fund).Īfter determining categories, divide your expected income among the expense categories until you have a plan for where each dollar will go. clothing, restaurants, entertainment), and, yes, savings (i.e. student loans, car payments, investments), fun (i.e. rent, utilities, groceries, healthcare), recurring monthly expenses (i.e.

“You are more accountable and likely to create changes because you are laying out something that you want.”įor my own spreadsheet, I came up with categories that encompassed my basic needs (i.e. “You don’t budget just to budget you need to know what your goals are,” Storjohann says. If you need help deciding on these categories, think about why you are creating a budget in the first place. Storjohann also suggests using expense categories to account for savings, whether that be for an upcoming trip, retirement, or a down payment. “Keeping it simple is great when you’re just starting out, like for understanding food, insurance expenses, home, rent, those sort of things.” Mary Beth Storjohann, a financial planner and the founder of Workable Wealth, tells HelloGiggles that the spreadsheet’s preset categories are a good start for budgeting beginners.

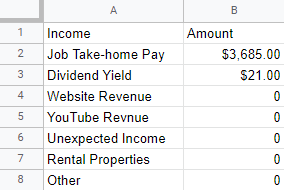

Next, enter your expected income for the month.

How to make a budget in Google sheets:įirst, enter a starting balance (aka the amount in your account at the start of the month). Perhaps the best part? The instructions for getting started are clearly outlined in the document. The summary page shows a monthly financial overview, while the transaction page lists actual expenses and income. Spread over two pages, the template includes everything a beginner budgeter might need. All you have to do is go to Google Sheets, hover over the plus icon at the bottom of the screen, and click “Choose Template.” And there, under the “Personal” category, is the “ monthly budget” template. Yet I’d never thought of using Google to manage my budget until a few months ago, even though the monthly budget template is a free preset that’s available to anyone with a Google account. I, like many, use Google for email, photo storage, and basically, everything else.

0 kommentar(er)

0 kommentar(er)